CIBC — Fraud Education Centre

Business context

With the shift to online banking and digital payments, customers have to be equipped with the tools and knowledge to spot anything illegitimate or fraudulent. While the CIBC website did have articles about types of scams to spot, we realised this was not a comprehensive source for our customers to learn about fraud and more importantly, what they can do to stay safe.

Solution

We worked with Corporate Security to redesign our existing fraud content into a fraud education hub. Overall, an improved hub for fraud education not only saves time and money for the bank and its customers, but it also creates the trust needed to grow and strengthen customers relationships.

Competitive analysis

I started by first doing an analysis of how CIBC’s main competitors structured their fraud information. The main takeaway from this was the need for a real “hub” for articles, hierarchy of information and immediate access to contact details.

User and industry research

A lot of our existing content described “customers’ responsibilities” to prevent fraud from happening, but the reality is that fraudsters are often two steps ahead, even in spite of our best efforts. So I wanted to understand how fraud can impact people outside of their banking. It became apparent that the best positioning of any content would be as an empathetic partner in fraud prevention.

Source: Better Business Bureau

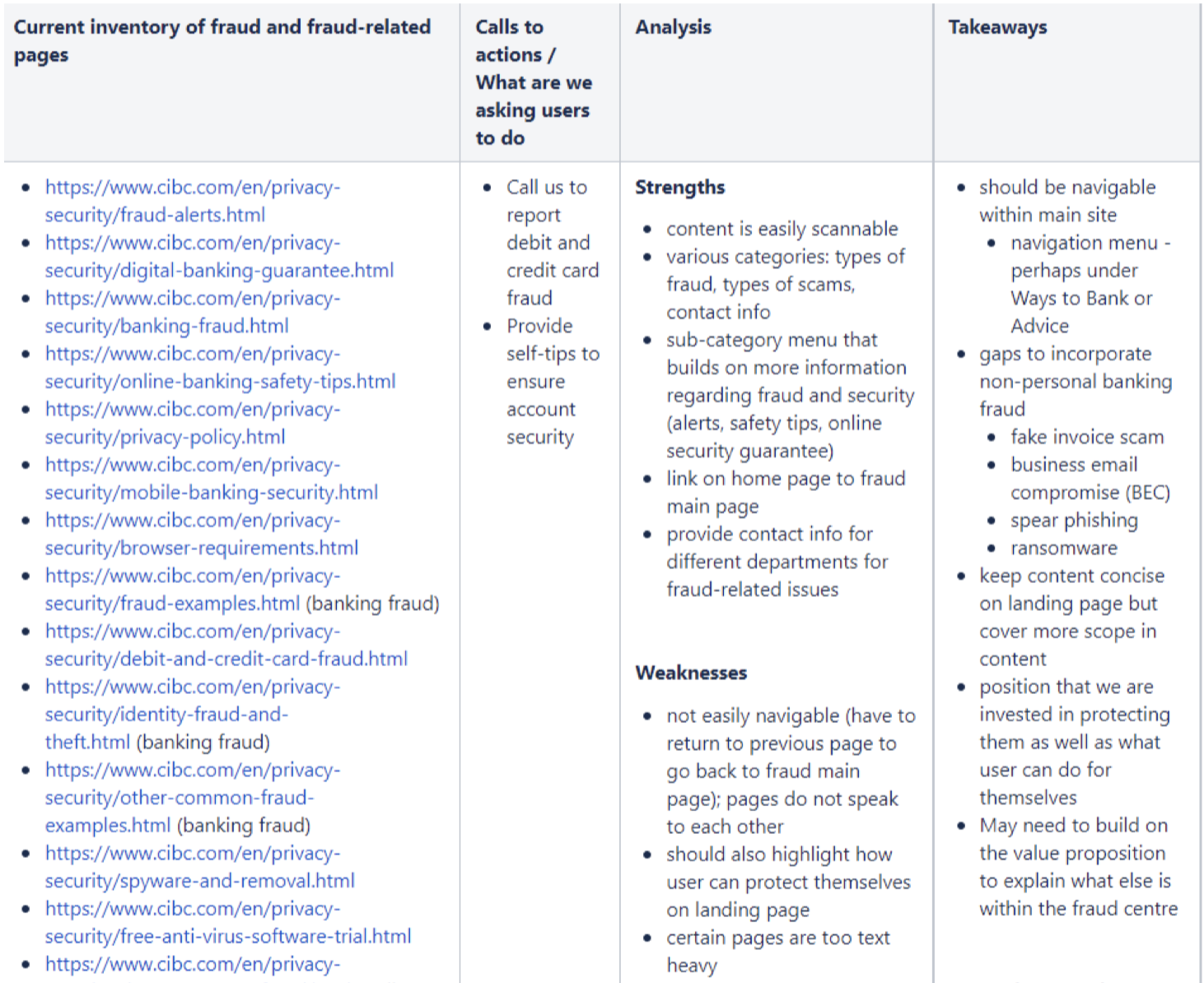

Content audit

Since we had existing fraud content on the site already, I did a content audit to not only source all the pages currently existing on the wider dotcom site, but also identify what the existing gaps and opportunities were that we could improve with fresh, new content.

Content goals and objectives

Finally, I laid out an outline of the content our new fraud education hub should include. This outline was used by my UX designer and visual designer to wireframe the new pages. Content goals included:

Creating a new landing page that gave customers a glance at the breadth of content they can expect within the hub, but also quickly point them to the information they’re looking for.

Distinguishing between personal fraud that affects customers, and business fraud that affects small-to-medium sized businesses.

Surfacing safety tips and advice from the scam articles so customers don’t have to click too much to get to the important details.

Writing a quiz so customers could have the opportunity to test themselves on the content.

Identifying which groups of clients were most vulnerable to fraud, and listed the most common scams that can affect each group.

Grouping our security features thematically so customers could understand what they can do to prevent fraud.

Linking to external sources for more fraud education. We didn’t want our content to come across as cross-sell opportunities, so including external sources was another way to build trust in our hub as a source of truth.